Returns rebound in 2022-23

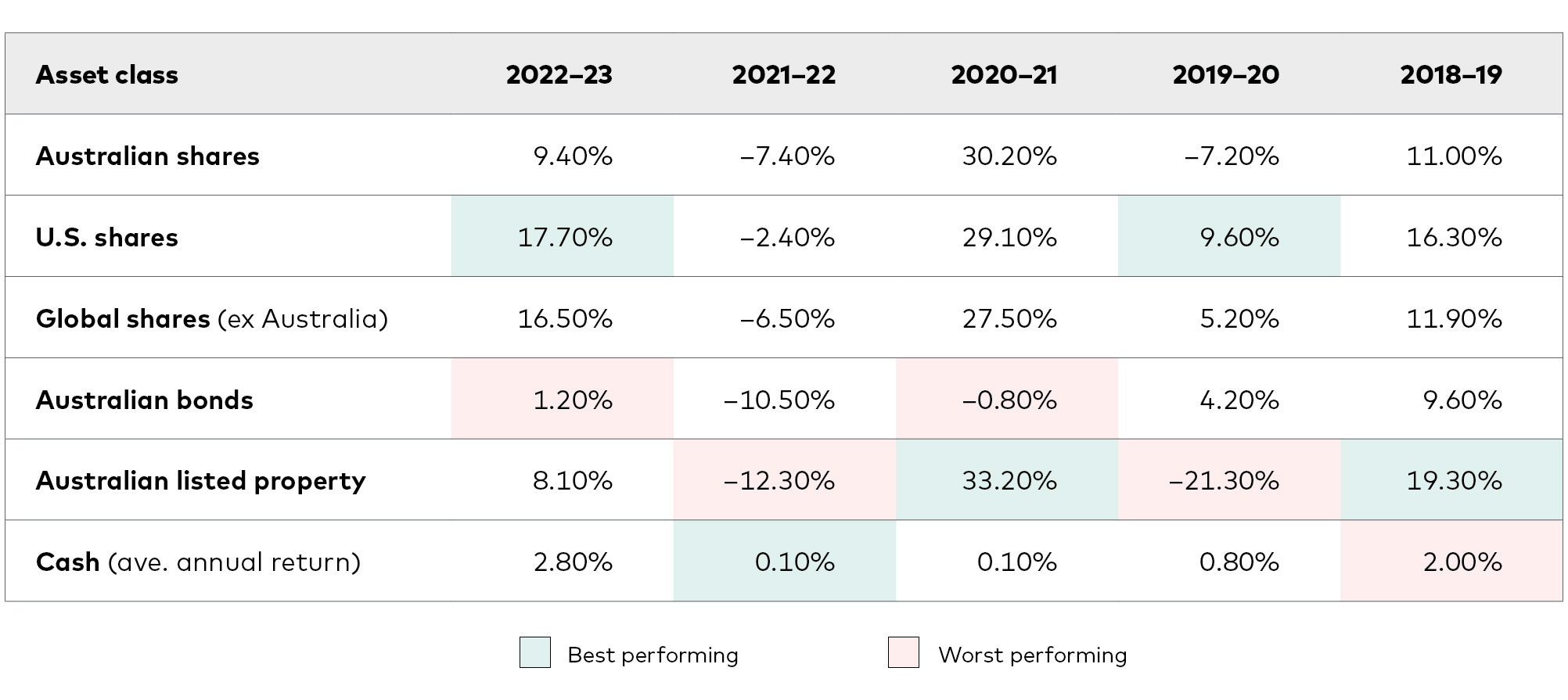

Investment markets rebounded in 2022-23. But it's important to understand that asset class returns vary from year to year.

.

Specific points in time can be useful for investors, although they’re generally less relevant over the long term.

Take the end of the 2022-23 financial year on Friday 30 June for example. It marked the end of a 12-month period during which fears about deteriorating economic conditions spurred ongoing volatility on global investment markets.

It was a similar story a year earlier at the end of the 2021-22 year as markets volatility led to negative investment returns across most asset classes, from shares to bonds.

Yet, despite the persistent volatility, 30 June 2023 marked a sharp turnaround in investment returns from the end of the previous financial year.

After falling more than 10% in 2021-22, the Australian share market as measured by the S&P/ASX 300 Index (which tracks the share prices of the 300 biggest companies listed on the Australian Securities Exchange) regained almost all of its lost ground.

From 1 July 2022 to 30 June 2023 the S&P/ASX 300 Index rose by just under 9.4%.

It was an even stronger 12-month period for investors on the United States share markets. The S&P 500 Index, which tracks the top 500 companies there, fell more than 11% in 2021-22. But between 1 July 2022 and 30 June 2023 it completely erased that loss by rebounding around 17.7%.

Meanwhile, after recording a fall of more than 10% in financial year 2021-22, the Australian fixed interest (bond) market – measured by the Bloomberg AusBond Composite 0+ Year Index – ended the 2022-23 financial year with a positive return of more than 1.2%.

That sharp turnaround in nominal, non-inflation-adjusted, terms largely reflects the impact of rising interest rates, which fuelled strong investor inflows into Australian and international bonds.

Just a line in the sand

The end of each financial year is relevant to many Australian investors from a taxation perspective.

Income distributions such as share dividends and bond coupon payments received over the period generally need to be recorded and declared by taxpayers for tax purposes.

Likewise, taxpayers generally need to record all their buy and sell transactions made during the financial year to track net capital gains and losses, also for tax purposes.

However, aside from the requirement to complete and lodge an income tax return with the Tax Office after 30 June each financial year, the crossover from one financial year to the next is merely just a line in the sand. Trading on investment markets will always resume on the first business day of a new financial year, typically changing all the market returns that were recorded as at the close of business at the end of the previous financial year.

Five financial years of returns

Sources: S&P/ASX 300 Index (Australian shares); S&P 500 Index (U.S. shares); MSCI World ex-Australia Net Total Return Index (Global shares ex Aust); Bloomberg AusBond Composite 0+ Year Index (Australian bonds); S&P/ASX 200 A-REIT Total Return Index (Australian listed property); Reserve Bank of Australia's Official Cash Rate (Cash).

Out of all of the asset classes listed above, in 2022-23 the U.S. share market produced the highest return, followed by global shares excluding Australia. In the previous financial year cash was the only asset class listed to deliver a positive return – albeit that after inflation, the purchasing power of cash savings declined.

High inflation levels are continuing to erode cash returns, and over the long term cash has produced the lowest return of all major asset classes.

The bottom line

When deciding where to invest, it’s important to understand that the best and worst performing asset classes will often vary year to year.

Successful investing often benefits from having a good balance of asset classes.

Rather than trying to pick the winning investment each year, spreading your investments across a wide range of assets may help to reduce the risk of loss over longer periods that could occur if you had all your capital tied to just one asset class.

Investors who are well diversified tend to enjoy a smoother investment ride over the long term.

Long-term returns data also suggests that time in the market will deliver consistent growth over longer periods despite periods of short-term volatility.

vanguard.com.au

Hot Issues

- Investment and economic outlook, March 2025

- Advisers should be aware of signs of elder abuse in SMSF structures

- SMSFs hold record levels of cash and property

- Trustees warned on early access

- The Largest Empires in the World's History

- All the documents, fact sheets and downloads to do with this year’s 2025-26 Federal Budget

- Winners and Losers - Federal Budget 2025-26

- Building Australia's future and Budget Priorities

- Four SMSF breaches high on the ATO’s radar

- Home is where the super is for many Australians

- Investment and economic outlook, February 2025

- TBC increase not just about pensions

- SAR non-lodgment continues to be a concern: ATO

- Increase in prohibited loans a concern: ATO

- Retiree confidence undermined

- The Most Held Currencies in the World | 1850-2024

- Up to 700k retirees could be paying more tax than they should: SMC

- Calls for clarification on NALI/E rulings

- Australia’s economic growth set to recover in 2025

- Carer rights - interdependency relationships

- Division 296 deliberately deceptive

- Five financial steps for the new year

- How to shift into pension mode

- Best Selling BOOKS of all Time

- Preparing your kids for financial success

- Investment and economic outlook

- It’s super hump month. Make the most of it

- Know the difference between general and specific NALE

- Super funds finish 2024 with double-digit returns

- 9 Ways You Can Invest Using SMSF

- End-of-year break time for super check-up

- Most Powerful Economies in Europe | 1960-2024

Article archive

July - September 2023 archive

- Single-asset segregation barred

- Intergenerational Report 2023

- Transferring wealth to the next generation

- Investment and economic outlook, August 2023

- Managing complex relationships in SMSFs comes down to well-crafted deeds

- Last chance for $25,000 super deduction

- Super gender divide to remain a challenge

- Oldest Buildings in the World

- Advice-Related Complaints Low Despite Huge Rise In General

- From purchase to lease, SMSF property documentation is essential

- Taxing unrealised capital gains a grave concern: Burgess

- Protect your business from cyber threats.

- Our investment and economic outlook, July 2023

- Understanding the role of custodians

- Returns rebound in 2022-23

- The top mode of transport in the world

- Tax alert warning could catch more in the ATO web

- Five questions that indicate how financially literate you are.

- Preparing for EOFY tax scams with business and cyber resilience

- High interest and inflation can pay dividends for SMSFs

- Australians need a retirement confidence boost

- The “secret” to financial freedom? Persist while others quit

- Top 50 Greatest Cuisines

- More Australians are unlocking home equity to fund retirement